The Best Guide To Broker Mortgage Rates

Wiki Article

Fascination About Mortgage Broker

Table of ContentsAbout Broker Mortgage FeesWhat Does Broker Mortgage Calculator Do?Some Known Details About Broker Mortgage Fees An Unbiased View of Mortgage BrokerMortgage Broker Vs Loan Officer - The FactsWhat Does Mortgage Broker Average Salary Do?5 Simple Techniques For Mortgage Broker Vs Loan OfficerBroker Mortgage Rates Fundamentals Explained

What Is a Mortgage Broker? The home mortgage broker will function with both parties to obtain the specific authorized for the funding.A mortgage broker typically works with numerous various lending institutions as well as can provide a selection of car loan options to the consumer they function with. The broker will gather info from the specific as well as go to multiple lenders in order to locate the best potential finance for their customer.

Mortgage Broker Average Salary for Dummies

All-time Low Line: Do I Required A Home Loan Broker? Functioning with a home loan broker can conserve the debtor time and initiative during the application procedure, and potentially a lot of cash over the life of the lending. Additionally, some loan providers function exclusively with home loan brokers, meaning that borrowers would have accessibility to financings that would otherwise not be available to them.It's essential to examine all the fees, both those you could need to pay the broker, along with any costs the broker can aid you prevent, when weighing the choice to collaborate with a home mortgage broker.

The smart Trick of Mortgage Broker Salary That Nobody is Talking About

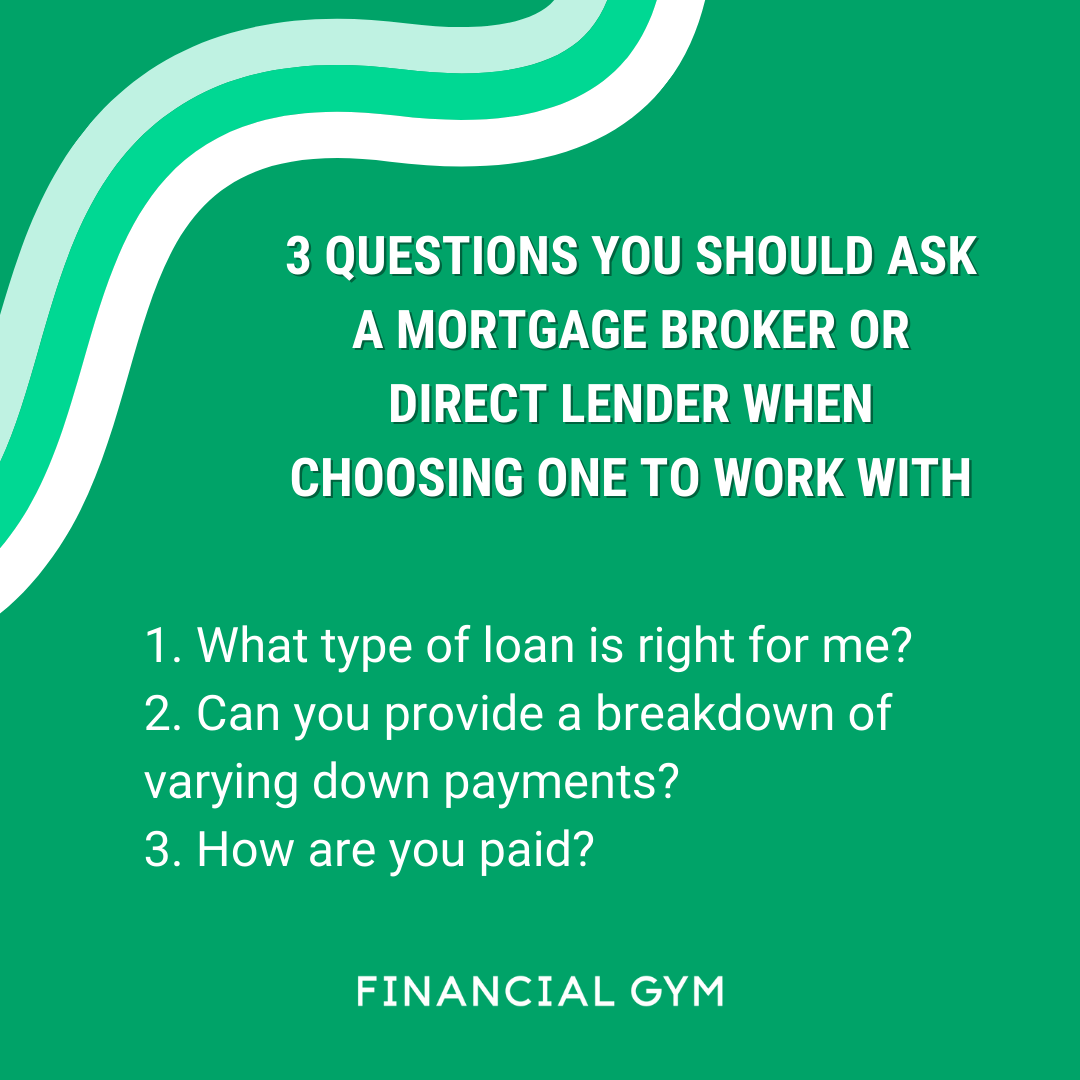

You have actually possibly listened to the term "mortgage broker" from your real estate agent or buddies that have actually acquired a house. What exactly is a mortgage broker and also what does one do that's various from, claim, a lending police officer at a financial institution? Nerd, Wallet Overview to COVID-19Get solution to inquiries regarding your mortgage, traveling, financial resources and keeping your tranquility of mind.1. What is a home mortgage broker? A home mortgage broker acts as an intermediary in between you as well as prospective lending institutions. The broker's job is to compare home loan lending institutions on your part and find rates of interest that fit your requirements - mortgage broker association. Home mortgage brokers have stables of lending institutions they work with, which can make your life simpler.

Some Ideas on Mortgage Broker Meaning You Need To Know

Just how does a home loan broker get paid? Home mortgage brokers are most typically paid by lending institutions, sometimes by debtors, yet, by law, never ever both.The competition and residence costs in your market will certainly contribute to dictating what home mortgage brokers fee. Federal legislation limits how high settlement can go. 3. What makes mortgage brokers various from financing officers? Car loan policemans are broker mortgage lender staff members of one lending institution who are paid established salaries (plus incentives). Funding officers can compose just the kinds of lendings their company chooses to supply.

9 Easy Facts About Broker Mortgage Fees Explained

Mortgage brokers may be able to provide consumers accessibility to a wide option of financing kinds. You can conserve time by utilizing a home loan broker; it can take hours to apply for preapproval with different loan providers, then mortgage brokers there's the back-and-forth interaction involved in underwriting the finance and guaranteeing the purchase stays on track.When selecting any loan provider whether through a broker or directly you'll want to pay interest to lending institution fees." After that, take the Financing Quote you obtain from each lending institution, position them side by side as well as contrast your passion rate and also all of the costs as well as closing costs.

Some Ideas on Mortgage Broker Average Salary You Should Know

5. Just how do I select a home loan broker? The very best means is to ask buddies as well as loved ones for recommendations, yet make certain they have actually made use of the broker as well as aren't just going down the name of a former college roommate or a far-off acquaintance. Discover all you can regarding the broker's services, communication design, degree of knowledge and also method to clients.

Mortgage Broker Average Salary Can Be Fun For Anyone

Competition and residence prices will certainly affect exactly how much mortgage brokers obtain paid. What's the difference between a mortgage broker and also a funding officer? Car loan officers work for one loan provider.

Some Ideas on Mortgage Broker Assistant You Need To Know

Buying a new home is among the most complicated occasions in an individual's life. Residence vary substantially in regards to design, facilities, school area and, certainly, the constantly important "location, place, area." The home loan application procedure is a complex aspect of the homebuying procedure, particularly for those without past experience.

Can identify which problems could create troubles with one lender versus one more. Why some purchasers prevent home loan brokers Sometimes property buyers feel much more comfy going directly to a big financial institution to secure their lending. In that case, customers must at the very least speak with a broker in order to comprehend every one of their options relating to the learn the facts here now sort of car loan as well as the offered rate.

Report this wiki page